30+ how to get 1098 form mortgage

However you can actually use a year end statement from your lender to enter your mortgage interest paid in 2015 as long as it is accurate. Get Access to the Largest Online Library of Legal Forms for Any State.

Tax Strategies Blog Greenbush Financial Group

If you dont receive a 1098 form that may mean that you paid less than 600 in interest.

. You can use this form to report the interest paid on a mortgage. Web If you meet the guidelines for receiving a 1098 form you can sign in to Online Banking select your mortgage account and then select the Statements Documents tab. Web How to get a 1098 Mortgage interest statement.

Ad A Simple Step-By-Step Process To Make IRS Tax Filing Easy. Its always a great time to Go Paperless. Web Using a Form 1098 Mortgage Interest Statement You can claim the mortgage interest youve spent on your home for a deduction when you file your federal income taxes.

Web Rocket Mortgage clients should get their paperless 1098 statements on the first business day of 2022 through their Rocket Mortgage Servicing Account. Web If you want to deduct the interest you can use the figures from the 1098 form sent by your mortgage company. This is the quickest and most convenient way of getting your statement for your tax return.

Here is the catch though. Web 30 how to get form 1098 mortgage Kamis 02 Maret 2023 Edit. Your mortgage lender will send you Form 1098 by 31st January of the tax filing year.

Ad The Leading Online Publisher of National and State-specific Legal Documents. The purpose of a Form 1099 is to record types of income received from sources other than. Ad Fill Sign Email IRS 1098 More Fillable Forms Register and Subscribe Now.

Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Consider contacting the first lender for your 1098-it may be on the way.

Web Instructions for Forms 1098-E and 1098-T Student Loan Interest Statement and Tuition Statement. Web Download your 1098 Form from Freedom Mortgage. Download or Email IRS 1098 More Fillable Forms Register and Subscribe Now.

Homeowners can use Form 1098 to figure their mortgage interest deduction on their annual tax return. Web 13 rows Instructions for Form 1098. Since the IRS may have the.

Qualifying Longevity Annuity Contract Information Info Copy Only Instructions for Form 1098-Q Qualifying Longevity Annuity Contract Information. Ad Download or Email IRS 1098 More Fillable Forms Register and Subscribe Now. Youll find a link to your 1098 form in the Year-end Statements section.

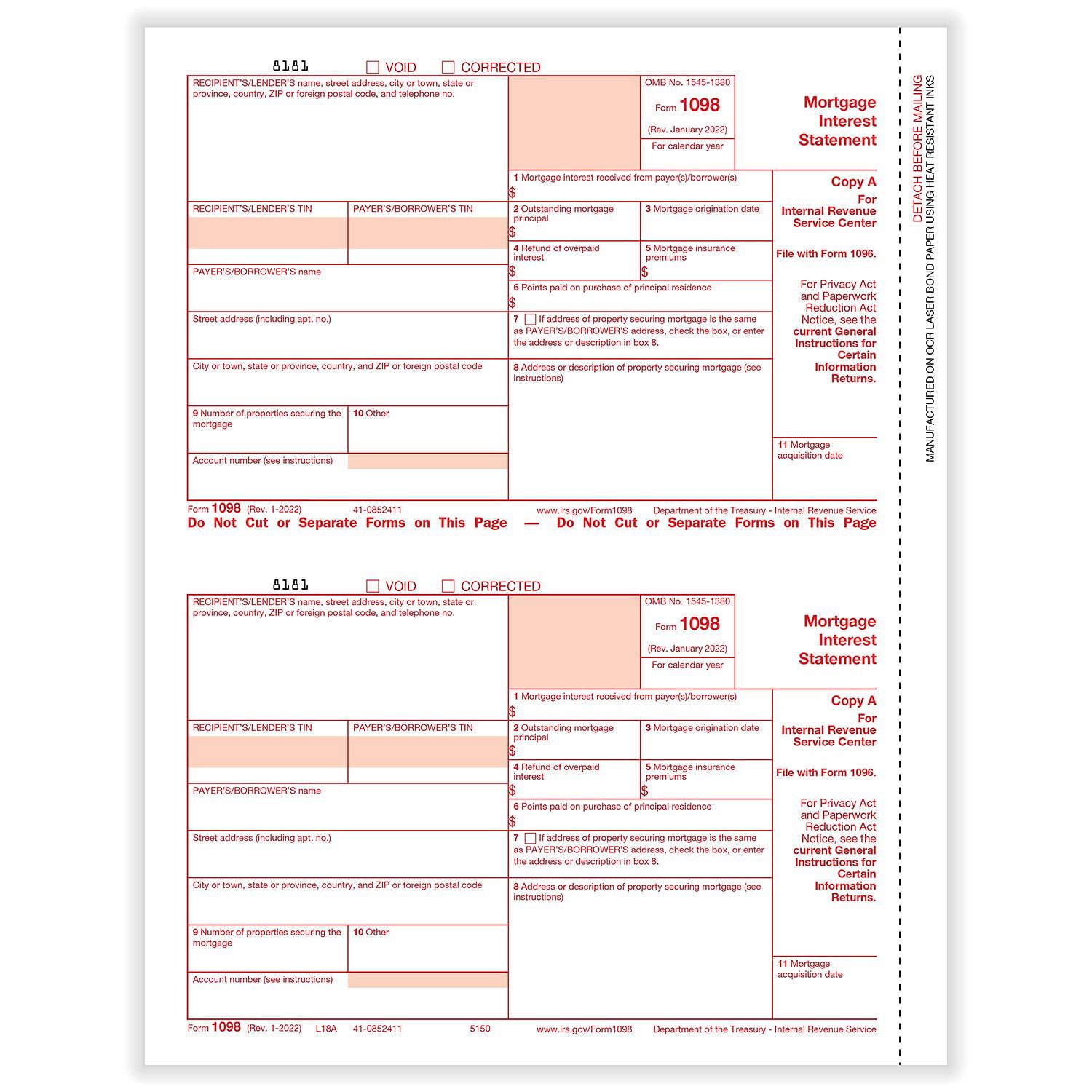

Web Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance premiums or points during the tax year. Web The Form 1098also known as Mortgage Interest Statementis used to report the amount of interest and related expenses you paid on your mortgage during the tax year. To download a copy log in to your account navigate to Account Details and then select Statements from the menu.

Web If you want to file your Federal Income Tax without waiting for your Mortgage Interest Statement 1098 Tax Form to arrive in the mail you can login to your account on our website and print your Mortgage Interest Statement 1098 Tax Form free of charge as. Web If you pay more than 600 in mortgage interest your lender will send you a 1098 form. However you must be the primary borrower on the loan and.

Web Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance. No Matter What Your Tax Situation Is TurboTax Has Your IRS Taxes Covered. Your 2022 year-end Mortgage Interest Statement will be available by January 31 2023.

To be able to claim the deduction youll need to itemize your taxes. Get Started With TurboTax. Web You can view a variety of statements including your mortgage escrow HELOC if applicable 1099 and 1098.

Lenders must file a separate Form 1098 for each mortgage. Log into your account and click Billing and Tax Documents to view and manage your documents. And use the calculation to claim a tax deduction.

Doorway Home Loans

Mortgage Interest Statement Form 1098 What Is It Do You Need It

Form 8 K Bank Of America Corp For Oct 14

Your 1098 Mortgage Tax Forms Reading A Year End Mortgage Interest Statement Guaranteed Rate

Tax Credits Vs Tax Deductions And Tax Refunds Britannica Money

Form 1098 Mortgage Interest Statement Community Tax

Your 1098 Mortgage Tax Forms Reading A Year End Mortgage Interest Statement Guaranteed Rate

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1893 Session I Education Sixteenth Annual Report Of The Minister

Free Tax Filing For Military Members

Here S How To Master Your Mortgage With The 1098 Form Pdffiller Blog

Continuous 1098 Mortgage Interest Carbonless Dated Deluxe Com

Irs Form 1098 Mortgage Interest Statement Smartasset

:max_bytes(150000):strip_icc()/Form1098-5c57730f46e0fb00013a2bee.jpg)

Form 1098 Mortgage Interest Statement And How To File

End Of Year Form 1098 Changes Peak Consulting

1098 Mortgage Interest Fed Copy A Cut Sheet 100 Sheets Pack

Kootenay News Advertiser May 30 2014 By Black Press Media Group Issuu

Exv10w12